As the population grows older most of us can look forward to around 20 years in retirement. This is good news. A comfortable retirement should be a reward for years spent at work. But what if we haven’t saved up for our retirement? Our dreams of time spent on holidays and hobbies might never come true.

As the population grows older most of us can look forward to around 20 years in retirement. This is good news. A comfortable retirement should be a reward for years spent at work. But what if we haven’t saved up for our retirement? Our dreams of time spent on holidays and hobbies might never come true.

Millions of us are not saving enough to afford the retirement we want.

The State Pension is a foundation for your retirement, but you may want more. Today, the full basic State Pension is £122.30 (March 2018) a week for a single person.

If you are of working age and you haven’t got round to starting a workplace pension, then there’s good news. The government has created a new initiative to help you build up a pension through your workplace. And the best news is the setting-up is all done by your employer. There is very little you have to do if you want to start saving for your retirement.

{youtube}5Sx7tRD8nTk{/youtube}

You will be automatically enrolled into a pension scheme at work if you:

- are not already in your employer’s pension scheme;

- are aged 22 or over;

- are under State Pension age;

- earn more than £10,000 a year (March 2018); and if you

- work, or usually work, in the UK.

You can choose to opt out of the scheme if you want to, but if you stay in you will have your own pension which you get when you retire.

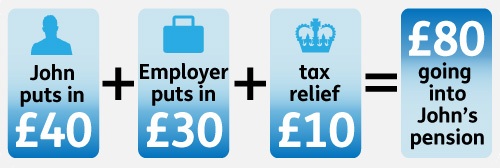

What’s more, if you stay in, your employer will contribute to your pension and the government will also contribute through tax relief*. This means, unlike other ways of saving, being in a workplace pension means you’re not the only one putting money in.

So:

- You pay into it

- Your employer pays into it

- The government pays into it (in the form of tax relief)

Example

John earns £12,000 a year (£1000 a month) gross** basic salary and is paid monthly.

- He pays in the equivalent of 4% of his gross salary into his workplace pension (£40 a month). This is taken directly from his monthly pay.

- His employer pays in the equivalent of 3% of his gross salary (£30 a month)

- The government, in the form of tax relief, pays the equivalent of 1% of his gross salary (£10 a month).

So the total contribution to John’s pension pot is £80 a month.

Please note this is just an example: how your employer’s pension scheme actually calculates payments will probably be different.

*Tax relief means some of your money that would have gone to the government as income tax, goes into your pension instead.

** ‘Gross’ means before tax and National Insurance are taken off

{youtube}6O4h3po2mQ4{/youtube}

To find out more about what enrolment into a workplace pension means for you, and the benefits of staying enrolled, visit www.direct.gov.uk/workplacepension