What could you do if you didn’t have a single debt payment in the world?

That’s right—no student loans, car payments or credit card bills! For some of you, that would free up an extra $300, $500, or maybe even $800 a month. Ah, that’s the debt-free life. The quickest way to make your debt-free dream a reality is to use the debt snowball method.

What Is the Debt Snowball Method?

The debt snowball method is a debt reduction strategy in which you pay off bills in order of smallest to largest, regardless of interest rate. But it’s more than a method for paying off bills.

The debt snowball is designed to help you change how you behave with money so you never go into debt again.

It forces you to stay intentional about paying one bill at a time until you’re debt-free. And it gives you power over your debt. When you pay off that first bill and move on to the next, you’ll see that debt is not the boss of your money. You are. This is how the debt snowball method works . . .

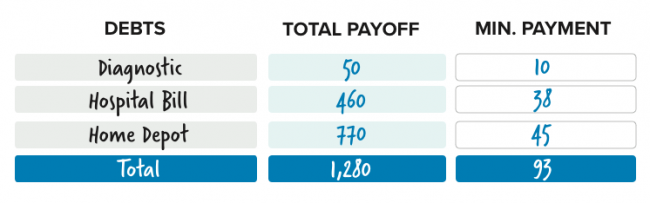

Step 1: List your debts from smallest to largest.

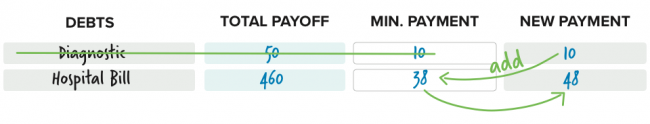

Step 2: Make minimum payments on all debts except the smallest—throwing as much money as you can at that one. Once that debt is gone, take its payment and apply it to the next smallest debt while continuing to make minimum payments on the rest.

Step 3: Repeat this method as you plough your way through debt. The more you pay off, the more your freed-up money grows—like a snowball rolling downhill.

The Fastest Way to Get Out of Debt

Sure, it might appear that paying off the debt with the highest interest rate first makes the most sense—mathematically. Wouldn’t that save you the most money?

Yes and no.

If you begin with the biggest debt, you won’t see traction for a long time. You might think you’re not making fast enough progress and then lose steam and quit before you even get close to finishing. It’s important to pay your debts in a way that keeps you motivated until you’ve wiped them out.

Getting quick wins in the beginning will light a fire under you to pay off your remaining debts!

Listen—knock out that smallest debt first, and you will find the motivation to go the distance.

Examples of non-mortgage debt:

- Payday loans

- Student loans

- Car repairs

- Credit card balances

- Home equity loans

- Personal loans

Is There Such A Thing As Good Debt?

And by the way, there’s no such thing as good debt. Take student loans, for example. Many consider student loans worthwhile debt, but the truth is, they hurt your finances in the long run. The average student loan debt per student is about $37,000. And the grand total of outstanding student loan debt has reached $1.41 trillion. Student loans are a huge roadblock to the financial success of young adults.

Think about it. Student loan repayment can seriously delay a person’s ability to buy a home, save money, and invest for the future. Bottom line: No debt is good debt.

When Am I Ready To Start The Debt Snowball?

You’re ready to begin your debt snowball once you’ve saved your $1,000 starter emergency fund. That’s what we call Baby Step 1.

An emergency fund covers those life events you can’t plan for. Think busted hot water heater, dental emergency or flat tire.

You get the drift. An emergency fund protects you from having to go further into debt to pay for an unexpected expense. So with that said, you’ll start your debt snowball on Baby Step 2. That means you’re current on all your bills and have completed Baby Step 1.

How Do I Start My Debt Snowball?

Organizing your debt snowball is simple.

Sit down with your spouse, if you have one, and begin listing out all your non-mortgage debt in order of smallest to largest.

From there, follow the guidelines we just covered and tackle the smallest debt first.

Move to the next smallest and the next and the next until you’re debt-free.

Good news! If you’re ready to get serious about paying off debt, we’ve created a free, three-day email series that gives you an in-depth, personalized, and guided approach to creating your own debt snowball.

FAQs

1. Why pay the smallest debt first instead of the one with the higher interest rate?

The point of the debt snowball is changing behavior.

If you pay off a student loan first because it’s the largest debt, you won’t see it leave the snowball for a while. You’ll see numbers going down on a spreadsheet, but that’s it. Pretty soon, you’ll lose steam and stop paying extra, but you’ll still have all your debts hanging around.

But when you ditch the small debt first, you see progress. That one debt is out of your life forever. Soon the second debt will follow, and then the next.

These little wins will give you a confidence boost, you’ll see that the plan is working, and you’ll stick to it.

2. How do I know when to sell something or pay it off?

Since this question usually comes up with cars, that’s a great place to start.

Here are two basic rules to remember.

First, if you need more than 24 months to pay off your car, it’s time to sell. Set a two-year deadline and use that—rather than your loan schedule—to decide what you should do.

Second, look at how much of your net worth is wrapped up in the car. If it’s more than 50%, you’re investing too much into something that goes down in value and it’s time to let it go. For other stuff—like boats, rental properties or anything other than your home—you can use the same general rules.

If you can’t pay it off quickly or if it cuts too deeply into your income, sell it!

Breaking free from those payments will drastically change your mindset and your wallet as you move toward becoming debt free. But if you own an item that will be paid off in a few months, it’s all right to keep it. Just get rid of the debt!

3. Should I keep saving for retirement while on Baby Step 2?

No. You want to commit all your energy and resources to getting out of debt while on Baby Step 2.

Diverting money toward retirement means you’ll stay in debt longer. Concentrate on one thing at a time. Even if you get a company match, don’t take it while you’re eliminating your debts. With a cut lifestyle, extra income from a second job (if you take one), and laser focus, you’ll get out of debt quickly and establish your full emergency fund. Then, you can go right back to investing. Being debt-free will more than make up for taking a year or two off of investing.

4. What if a baby is on the way?

First off, congratulations! A baby is always cause for celebration.

If you’re expecting, stop the debt snowball and pile up cash. Keep making your minimum payments, but stock away all the remaining money.

If an emergency happens and you have medical bills, you’ll have the money to pay them. Once your new bundle of joy is home from the hospital and everyone is all right, then take your saved money and apply it to the debt snowball.

5. What if I get laid off from my job while paying off debt?

If you lose your job, go into survival mode. Make sure your lifestyle is slashed to the basics. Keep making your minimum payments, without putting anything extra toward the debt. Stop the debt snowball until you find work again (and get a side job or do freelance work until you land a full-time position with another company).

If you get severance pay, don’t kick back and live off of that. Try not to touch it. Live bare bones and hunt like crazy for work. The sooner you get a new job, the sooner that severance looks like a huge bonus that you can apply toward the debt snowball.

Hopefully, you’ve now got a better idea of how the debt snowball works. It truly is the best plan available for getting out of debt because it works for everyone in every situation, and we can’t wait to see how well it works for you!

Ready to get started paying off debt using the debt snowball method? Learn how with Dave Ramsey’s Financial Peace University class.

Article Republished with kind permission from Ramsey Solutions

Disclaimer

This information is general in nature and has not taken into account your personal financial position or objectives. Before proceeding please refer to a licensed debt adviser such as CAP UK or the Money Advice Trust.

None of the material contained in this website is to be relied upon as a statement or representation of fact and DAD.info gives no warranty as to the accuracy of this information. DAD.info is not giving advice or recommendation by virtue of having provided information on this site. It is not possible for DAD.info to review the content of all the websites to which this website links and we cannot be held liable for their content. DAD.info does not endorse the content of any external websites.